Marin County Probate Records

Marin County Superior Court maintains probate court records at the Civic Center courthouse located at 3501 Civic Center Drive in San Rafael. The probate division processes all estate administration matters for this affluent Bay Area county, including wills, trusts, conservatorships, and guardianships. Office hours run from 9 AM to 4 PM on weekdays. Call the probate division at 415-444-7040 to speak with staff about filing procedures or case status. Marin County offers an online ePortal for searching probate records and viewing case documents remotely. The county's high property values and complex estates often involve significant real estate holdings, business interests, and substantial financial assets requiring careful management during probate proceedings.

Marin County Probate Quick Facts

Online Case Access

Marin County operates an ePortal for probate case searches. Visit eportal.marin.courts.ca.gov to look up cases by name or number. The system shows filed documents, hearing dates, and case status for both active and closed matters.

You can view many documents through the portal without charge. Some documents may require payment to download or print. Certified copies must be requested through the clerk's office. Processing time for certified copies is usually three to five business days.

The ePortal allows you to track case progress from home. Create a free account to access additional features. Without an account, you can still search but with limited viewing options. The portal works on computers, tablets, and smartphones.

For historical records not available electronically, contact the clerk's office directly. Older files may be stored offsite. Retrieval can take several weeks depending on the age of the case.

San Rafael Courthouse

The Marin County courthouse sits at the Civic Center in San Rafael. This iconic Frank Lloyd Wright designed building houses the probate division. Public parking is available in lots around the Civic Center campus.

The probate division operates from 9 AM to 4 PM on weekdays. Arrive early if you need help with forms or have questions. Staff can assist you during these hours. The office closes promptly at 4 PM.

The court website at marin.courts.ca.gov provides probate division information and resources. Check the site for holiday closures and schedule changes. The website posts updates about court operations and procedures.

Clerk staff accept filings and answer procedural questions. They provide forms and process payments. They cannot give legal advice about your specific case. For legal guidance, consult an attorney or use self-help resources.

Starting a Probate Case

Begin probate by filing form DE-111, the Petition for Probate. Attach a certified death certificate and the original will if one exists. The filing fee is $435. Pay by cash, check, or money order at the clerk window.

After filing, the court schedules a hearing. This is typically six to eight weeks from the filing date. You must notify all interested parties before the hearing. Send written notice to heirs and beneficiaries by mail. Publish notice in an approved newspaper.

Marin County has several newspapers that meet legal publication requirements. The Marin Independent Journal is commonly used. Ask the clerk for the complete approved list. Using an incorrect newspaper means republishing and delaying your case.

File proof of mailing and proof of publication before the hearing date. The judge reviews these proofs to confirm proper notice was given. Missing proofs delay your case and may require rescheduling the hearing.

At the hearing, the judge reviews your petition and all supporting documents. The judge asks questions about the estate and your qualifications to serve. If everything is in order, the judge grants probate and issues Letters. These documents authorize you to manage estate assets, pay debts, and handle distributions.

Complex Estate Considerations

Marin County estates often involve substantial values. Real estate in cities like Mill Valley, Tiburon, and Sausalito commands premium prices. Many estates exceed several million dollars in value. High-value estates need careful management and often require professional help.

Real property valuations matter greatly in Marin County. Bay views, waterfront access, and location significantly affect values. The probate referee values real estate but typically relies on professional appraisals. Expect these appraisals to cost more than in less expensive areas.

Many Marin County decedents owned business interests, investment portfolios, and retirement accounts. These assets need specialized valuation and handling. Business valuations can be complex and time consuming. Retirement accounts have specific tax implications requiring careful planning.

Estate taxes become a concern with high-value estates. Federal estate tax applies to estates over $13.61 million in 2024. While California has no state estate tax, federal tax must be addressed. Consult a tax professional or estate attorney for guidance on tax issues.

Trust administration often runs parallel to probate. Many Marin County residents used living trusts for estate planning. Trust assets bypass probate but still need administration. Coordinate trust and probate administration carefully to avoid conflicts.

Asset Inventory and Appraisal

Within four months of receiving Letters, file form DE-160. This Inventory and Appraisal lists all estate assets. Include real estate, bank accounts, investments, vehicles, and personal property. Do not omit anything.

A court-appointed probate referee values most assets. The referee researches values and completes the appraisal. Real estate requires separate professional appraisals in most cases. The referee coordinates these appraisals and compiles the final inventory.

The referee charges fees based on asset values. This is a statutory percentage set by California law. For high-value Marin County estates, referee fees can be substantial. The fee comes from estate funds, not your personal money. The referee's final report shows all fees charged.

Keep detailed records of all estate transactions from day one. Document money coming in and going out. Save receipts and statements. You will need these records when filing accountings. Good records prevent disputes and simplify the closing process.

Small Estate Procedures

Estates valued under $208,850 may use simplified procedures. This threshold applies to deaths on or after April 1, 2025. However, few Marin County estates qualify due to high property values. Even modest homes often exceed the limit.

Small estate affidavits work for personal property under the limit. Wait 40 days after death. Then present the affidavit to whoever holds the property. They must release it without court involvement. No hearing is required.

Real property valued under the limit uses a different process. You still file a petition and attend a hearing. However, the procedure is simpler than full probate. Fewer documents are needed and the timeline is shorter.

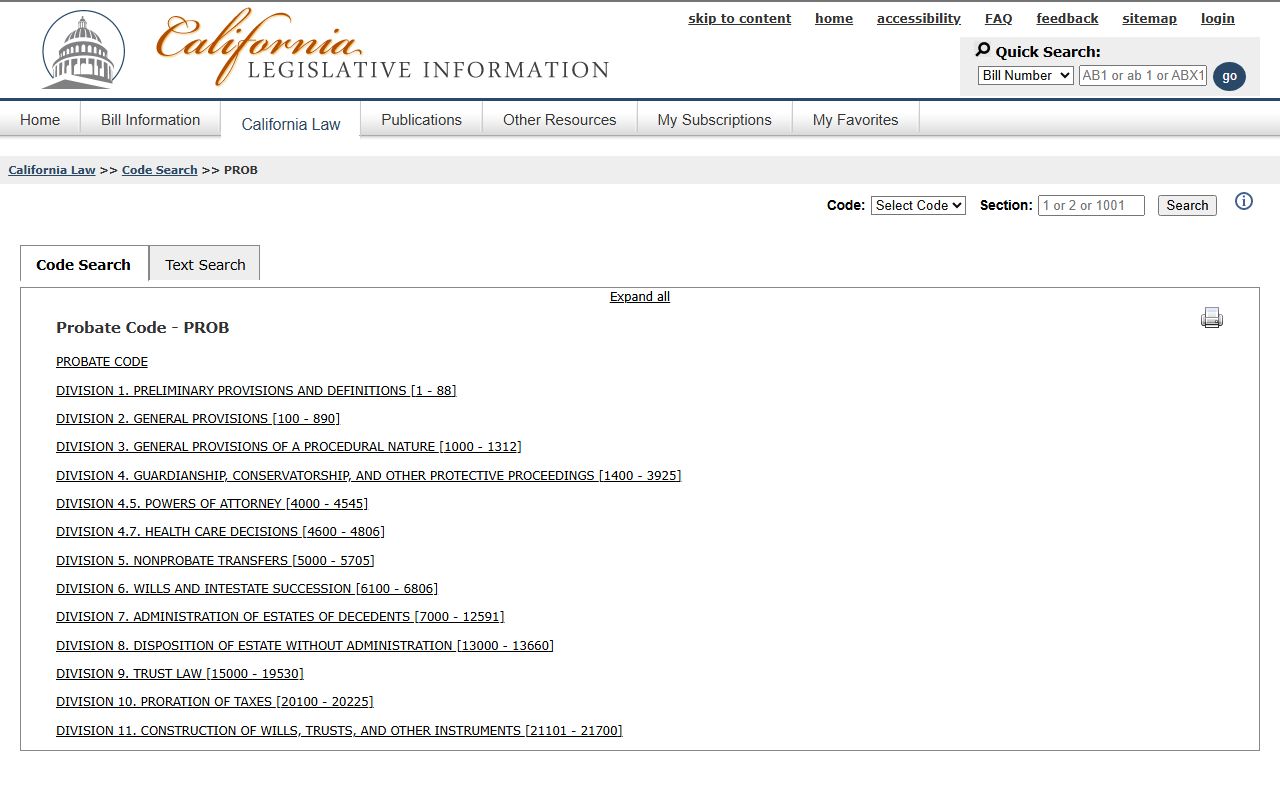

Note: The small estate threshold increases every three years per California Probate Code section 890.

Required Forms and Fees

California uses standard forms for probate cases. Download them from courts.ca.gov or get copies at the courthouse. The DE series covers estate matters. Each form includes instructions explaining how to complete it.

The initial filing fee is $435. Final distribution petitions cost another $435. Certified copies run $40 plus 50 cents per page. Other miscellaneous fees apply to various filings.

Attorney fees and executor fees are based on estate value in California. The statutory fee schedule provides percentages for different value ranges. High-value Marin County estates generate substantial fees. Understand these costs before beginning probate.

Finding Legal Help

The California Courts self-help website at selfhelp.courts.ca.gov provides free resources. Find forms, guides, and videos explaining probate procedures. The site answers frequently asked questions.

Legal aid organizations serve some Marin County residents who qualify based on income. However, the county's high cost of living means many residents fall outside income limits for free services.

Private probate attorneys practice throughout Marin County. Given the complexity and value of typical Marin estates, professional legal help is often advisable. Many attorneys charge statutory fees based on estate value. The Marin County Bar Association operates a lawyer referral service. Most attorneys offer free initial consultations.

Nearby Counties

For probate matters in neighboring counties, see: Sonoma County, San Francisco County, and Contra Costa County.