Find Probate Records in Merced County

Estate cases, guardianships, and conservatorships in Merced County are processed through the Superior Court probate division located at 627 West 21st Street in Merced. This courthouse serves the entire county for all probate matters. The clerk office handles filings Monday through Friday during standard business hours. You can reach the court at 209-725-4111 for general questions about probate procedures. Note that Merced County probate case information is not available through online search. You must contact the clerk office directly or visit in person to check case status and obtain documents related to probate proceedings.

Merced County Probate Quick Facts

Merced County Superior Court

All probate cases for Merced County get filed at the courthouse on West 21st Street. The building houses the probate division along with other civil court departments. Clerk staff can help you with basic filing questions and provide forms. They cannot give legal advice about your specific case.

The main phone number for the court is 209-725-4111. This line can direct you to the appropriate department for probate matters. Court hours are typically 8 AM to 4 PM on weekdays. Check with the clerk office for any holiday closures or modified schedules.

Visit the Merced County court website at merced.courts.ca.gov for general information about probate procedures. The site provides contact details and basic guidance. Most Judicial Council forms are available through the statewide California Courts website rather than the local court site.

Parking is available in public lots near the courthouse. Street parking is also an option but may have time limits. Arrive early for scheduled hearings to allow time for parking and security screening at the courthouse entrance.

Starting a Probate Case

To open an estate case in Merced County, prepare form DE-111 Petition for Probate. Obtain a certified death certificate from the county recorder or state vital records office. Gather the original will if one exists. Bring these documents to the clerk office at 627 West 21st Street.

The filing fee is $435. Pay by cash, check, or money order. The clerk stamps your documents and assigns a case number. They schedule a hearing date about six to eight weeks out. Make note of this date as you must complete several tasks before the hearing.

After filing, publish notice once a week for three consecutive weeks in a newspaper of general circulation in Merced County. The Merced Sun-Star is commonly used. You also send notice by mail to all heirs and beneficiaries. File proof of publication and proof of mailing with the court at least five days before your hearing.

At the hearing, the judge reviews your petition and supporting documents. Bring copies of everything you filed. If approved, the judge issues an Order for Probate and Letters. These Letters give you authority to act on behalf of the estate. You can then access bank accounts, sell property, and pay debts.

Within four months of receiving Letters, file an Inventory and Appraisal. This form lists all estate assets and their values. Certain assets require appraisal by a court-appointed probate referee. The court can provide a list of approved referees serving Merced County.

Obtaining Court Documents

Merced County does not offer online probate case search. To check case status or get information about a specific case, call 209-725-4111 or visit the clerk office in person. Bring the case number if you have it. Staff can look up cases by party name as well.

Court files are public records. You can view them at the courthouse during business hours. Ask clerk staff for access to the file room. They will pull the file for you to review. You cannot remove files from the courthouse, but you can take notes or request copies.

Copy fees are $0.50 per page. Certified copies cost $40 for the first page plus $0.50 for each additional page. Submit a written request listing the specific documents you need copied. Include the case number and party names. Processing time for copy requests is typically a few business days.

For documents by mail, send your request to Superior Court of California, County of Merced, Attn: Civil Clerk, 627 W 21st Street, Merced, CA 95340. Include payment for estimated copy fees. The clerk office will contact you if additional fees are needed.

Legal Help and Resources

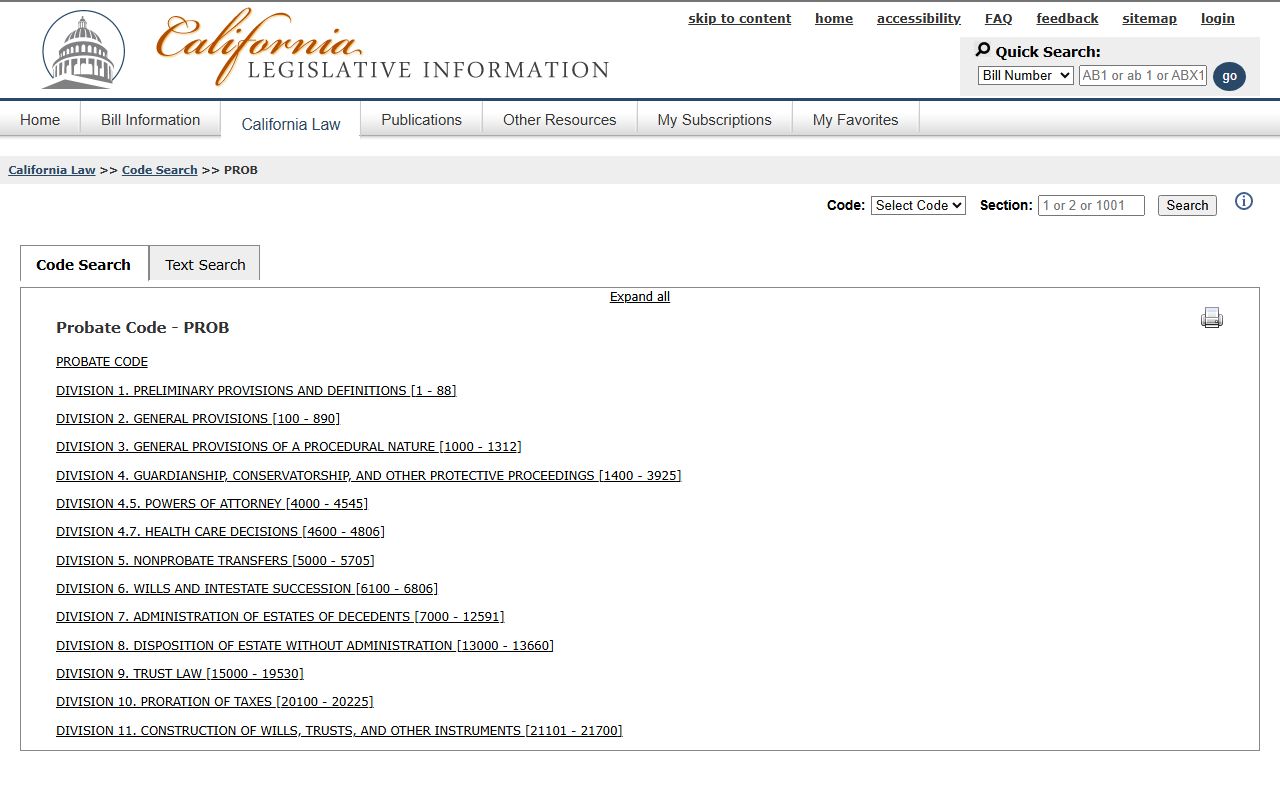

Merced County residents can access probate information through statewide self-help resources. The California Courts website at selfhelp.courts.ca.gov offers detailed guides about estate administration. The site includes videos, forms, and answers to common questions about probate procedures.

For personalized legal advice, consider consulting a probate attorney. The State Bar of California operates a referral service to connect you with local lawyers. Many attorneys offer initial consultations at reduced rates. Ask about flat fee arrangements for straightforward probate cases.

Legal Services of Northern California may assist eligible low income residents with probate matters. Contact their office to see if you qualify for free legal help. They serve several counties including Merced.

The court clerk office can provide procedural information but cannot give legal advice. They can tell you what forms to file and explain court rules. They cannot tell you whether to file probate or how to handle specific legal issues in your case.

Small Estate Procedures

Estates valued at $208,850 or less may qualify for simplified procedures. These avoid the cost and delay of full probate. California offers two main small estate options depending on the type of property involved.

For personal property like bank accounts, stocks, and vehicles, use form DE-305 Affidavit for Collection or Transfer of Personal Property. This affidavit lets you collect assets without court supervision. Present it to banks and other institutions holding estate property. Wait at least 40 days after death before using this procedure. No court filing is required for personal property affidavits.

Real property valued at $70,000 or less can be transferred using form DE-310 Affidavit Re Real Property of Small Value. File this affidavit with the court and pay a small filing fee. The court issues an order that you record with the county recorder. This transfers title to the heirs without full probate.

The current small estate threshold of $208,850 applies to deaths on or after April 1, 2025. Different limits applied to earlier deaths. Check the date of death to determine the correct threshold for your case.

Note: Calculate the estate value carefully. Include all assets owned by the decedent, not just those subject to probate. Real property is valued at fair market value minus liens. Consult with an attorney if the estate value is close to the threshold.

Cities in Merced County

Merced County includes the city of Merced, which has a population over 100,000. All probate cases for city residents are filed at the county Superior Court. The city does not operate its own probate court.

Adjacent Counties

For probate services in neighboring counties, see: Stanislaus County, Mariposa County, Madera County, and San Joaquin County.