Napa County Probate Court Filings

Probate matters in Napa County are handled through the civil division of the Superior Court. The courthouse is located at 825 Brown Street in the city of Napa. Estate administration, conservatorships, and guardianships are processed at this location. The clerk office is open Monday through Friday from 8 AM to 4 PM for filing documents and answering questions. Call 707-299-1130 to reach the civil division with probate inquiries. Napa County is known for its wine country, and the court serves both permanent residents and those who owned property in the county. All probate filings follow standard California procedures using Judicial Council forms.

Napa County Probate Quick Facts

Napa Superior Court Civil Division

The Napa County courthouse at 825 Brown Street handles all court matters for the county. Probate cases are part of the civil division. The clerk office processes probate filings along with other civil cases. Staff can answer basic questions about forms and procedures.

Court hours are 8 AM to 4 PM on weekdays. The office closes for lunch from noon to 1 PM most days. Call ahead at 707-299-1130 if you plan to visit to make sure staff are available. Arrive early if you need help with filings or have questions about your case.

The Napa County court website at napa.courts.ca.gov provides information about the civil division. The site includes contact details and basic procedural information. Probate forms are available through the statewide California Courts website.

Parking near the courthouse includes street parking and public lots. The downtown Napa area can be busy, especially during tourist season. Plan extra time to find parking and walk to the courthouse. The building is accessible for people with disabilities.

How to File Probate in Napa County

Start a probate case by filing form DE-111 Petition for Probate at the civil clerk window. Bring a certified death certificate. If there is a will, file the original with the court. Pay the $435 filing fee with cash, check, or money order.

The clerk assigns a case number and schedules your first hearing. This is usually six to eight weeks from the filing date. You must publish notice in a local newspaper. The Napa Valley Register is commonly used for this purpose. Publish once weekly for three consecutive weeks. Also mail notice to all heirs and beneficiaries named in the will or identified under California intestate succession laws.

File proof of publication and proof of mailing with the court before your hearing. The newspaper provides an affidavit of publication after the third notice runs. You prepare the proof of mailing by listing everyone who received notice and signing it under penalty of perjury.

At the hearing, the judge reviews your petition and supporting documents. If everything is complete and proper, the judge issues an Order for Probate and Letters. The Letters authorize you to act as estate representative. You can then manage estate accounts, sell property, and pay debts.

Within four months of receiving Letters, file an Inventory and Appraisal. List all estate assets and their values. Some items require appraisal by a court-appointed probate referee. The court maintains a list of approved referees. They charge fees based on the value of property appraised.

Accessing Court Records

Napa County does not currently offer online case search for probate records. Contact the civil clerk office at 707-299-1130 to check case status or obtain information about specific cases. You can also visit in person during business hours.

Court files are public records unless sealed by court order. Request to view files at the clerk window. Staff will pull the file for you to examine. You can review documents at the courthouse but cannot take files out of the building. Bring paper and pen to take notes if needed.

To get copies of documents, submit a written request specifying which documents you need. Include the case number and party names. Copy fees are $0.50 per page. Certified copies cost $40 for the first page plus $0.50 for additional pages. Payment is required when you submit your request.

For copies by mail, send your request to Superior Court of California, County of Napa, 825 Brown Street, Napa, CA 94559. Include as much detail as possible about the case and documents needed. Enclose payment or ask for a fee estimate. Processing time is typically one to two weeks.

Legal Assistance Options

Napa County does not operate a dedicated self-help center for probate cases. However, clerk staff can provide general procedural information. They can tell you what forms are required and explain basic court rules. They cannot give legal advice or help with strategy decisions in your case.

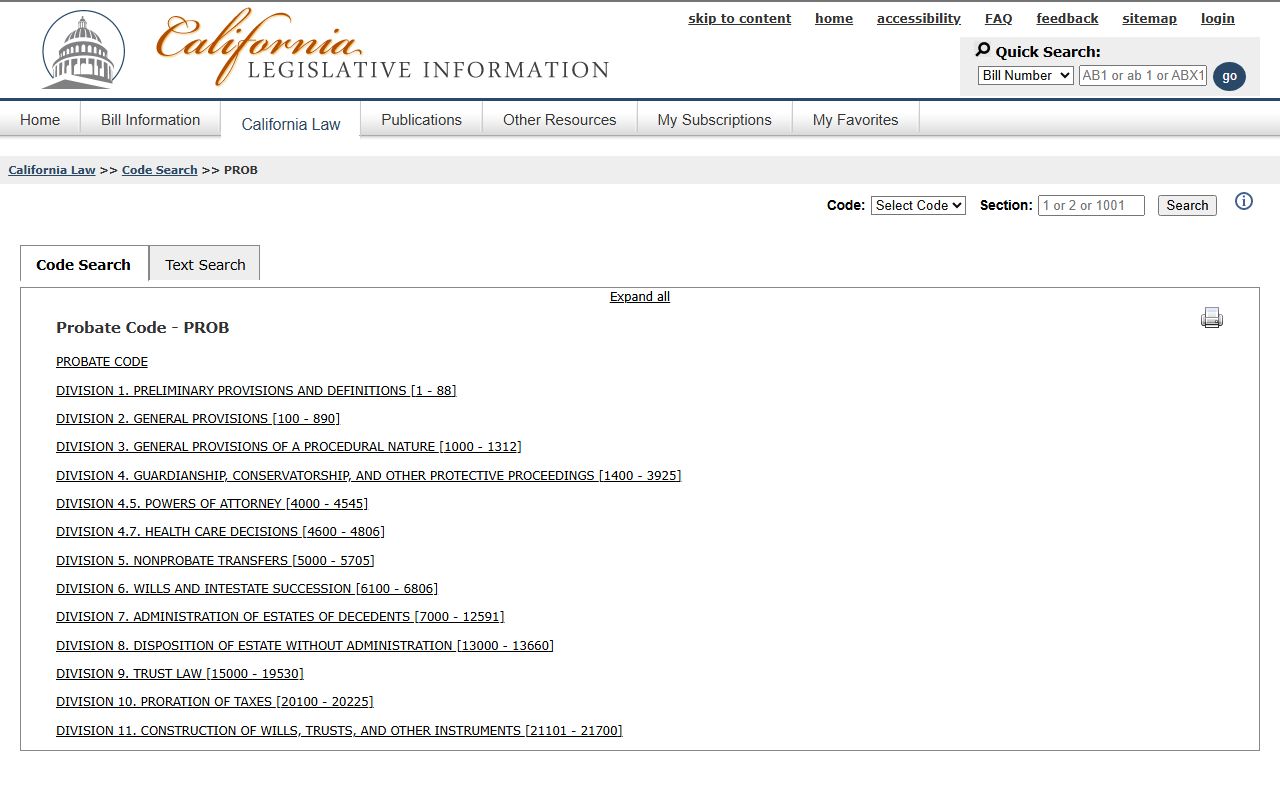

The California Courts Self-Help Center at selfhelp.courts.ca.gov offers comprehensive probate resources. This statewide site includes video tutorials, step by step guides, and answers to frequently asked questions. Live chat support is available during business hours for procedural questions.

Legal aid organizations may assist qualified low income residents with probate matters. Contact Legal Services of Northern California to see if you meet their income guidelines. They provide free legal help to eligible clients.

For personalized legal advice, hire a probate attorney. The State Bar of California operates a lawyer referral service. Call to get names of attorneys practicing in Napa County. Many offer initial consultations to discuss your case and explain their fees. Some handle routine probate cases on a flat fee basis.

Small Estate Alternatives

If the total estate value is $208,850 or less, you may not need full probate. California provides simplified procedures for small estates. These are faster and less expensive than regular probate administration.

Use form DE-305 Affidavit for Collection or Transfer of Personal Property for bank accounts, stocks, vehicles, and similar assets. Wait at least 40 days after death. Present the completed affidavit to institutions holding estate property. They will release assets to you without court involvement. There is no filing fee for personal property affidavits.

For real property valued at $70,000 or less, use form DE-310 Affidavit Re Real Property of Small Value. File this with the court and pay a filing fee. The court reviews it and issues an order. Take the order to the county recorder to transfer title. This avoids full probate but still requires some court process.

The $208,850 threshold applies to deaths on or after April 1, 2025. Different limits applied to earlier deaths. Use the date of death to determine which threshold applies to your situation.

Note: Even small estates may require full probate if complications exist. Disputes among heirs, significant creditor claims, or unusual assets may make simplified procedures unavailable. Consult an attorney if your situation involves any complexity.

Neighboring County Courts

For probate services in counties adjacent to Napa, check these resources: Sonoma County, Solano County, Yolo County, and Lake County.