Kern County Probate Court Records

Kern County probate court records are filed and maintained at the Superior Court located at 2100 College Avenue in Bakersfield. The probate division processes all estate administration matters for the county, including wills, trusts, conservatorships, and guardianships. The court serves one of California's fastest-growing counties, handling cases for both Bakersfield residents and people living throughout the rural areas. Call the probate division at 661-610-6000 and press option 5 to reach staff who can answer questions about filing procedures and case status. The county's oil industry and agricultural operations mean many estates include business interests and mineral rights that require special attention during probate proceedings.

Kern County Probate Quick Facts

Probate Division Location

The Kern County courthouse operates on College Avenue in Bakersfield. This central location serves the entire county. The probate division occupies dedicated space within the courthouse complex. Parking is available in lots surrounding the building.

Security screening occurs at the courthouse entrance. Arrive early to allow time for this process. Large bags and certain items cannot be brought inside. Leave unnecessary items in your vehicle.

The court website at kern.courts.ca.gov provides division information and resources. Check the site before visiting to see any closures or schedule changes. The website posts updates about court operations and procedures.

Clerk staff accept filings and answer procedural questions. They cannot give legal advice or tell you what to do in your specific case. For legal guidance, consult an attorney or use self-help resources available through the California Courts website.

The probate division maintains a list of approved probate referees. Michael Burger serves as a local referee and can be reached at 661-588-4381. The referee values estate assets as part of the inventory and appraisal process. Referee assignments rotate based on case filings.

How to File a Probate Case

Start probate by filing form DE-111, the Petition for Probate. Attach a certified death certificate and the original will if one exists. The filing fee is $435. Pay by cash, check, or money order at the clerk window.

The court schedules a hearing after you file. This is typically six to eight weeks from the filing date. You must notify all interested parties before the hearing. Send written notice to heirs and beneficiaries by mail. Publish notice in an approved newspaper.

Kern County has several newspapers that meet legal publication requirements. The Bakersfield Californian is commonly used for probate notices. Ask the clerk for a complete list of approved publications. Make sure you use a qualifying newspaper to avoid having to republish.

File proof of mailing and proof of publication before your hearing date. The judge reviews these proofs to confirm proper notice was given. Missing proofs will delay your case and may require rescheduling the hearing.

At the hearing, the judge reviews your petition and supporting documents. The judge asks questions about the estate and your qualifications to serve. If everything is in order, the judge grants probate and issues Letters. These documents authorize you to manage estate assets, pay debts, and handle distributions.

Oil, Gas, and Agricultural Estates

Kern County leads California in oil production. Many estates include mineral rights, royalty interests, or working interests in oil and gas operations. These assets need specialized handling during probate. Production continues during estate administration. Track all income and expenses carefully.

The probate referee values mineral rights and royalty interests. However, these appraisals often require input from petroleum engineers or industry specialists. The referee may hire experts to provide opinions on value. These expert fees come from the estate.

Agricultural operations also present unique challenges. Crops in the ground, livestock, and equipment all need proper management during probate. You may need court approval to continue farming operations. File a petition requesting authority to operate the business until the estate closes.

Water rights attach to much agricultural land in Kern County. These rights carry significant value and must be properly documented. The Kern Water Bank and various irrigation districts maintain allocation records. Check with these entities to confirm all water rights attached to estate property.

Business entities complicate some estates. Oil companies, farming corporations, and partnerships need ongoing management. Review operating agreements and corporate documents. Some may restrict transfer of ownership interests or require specific procedures during probate.

Required Forms and Costs

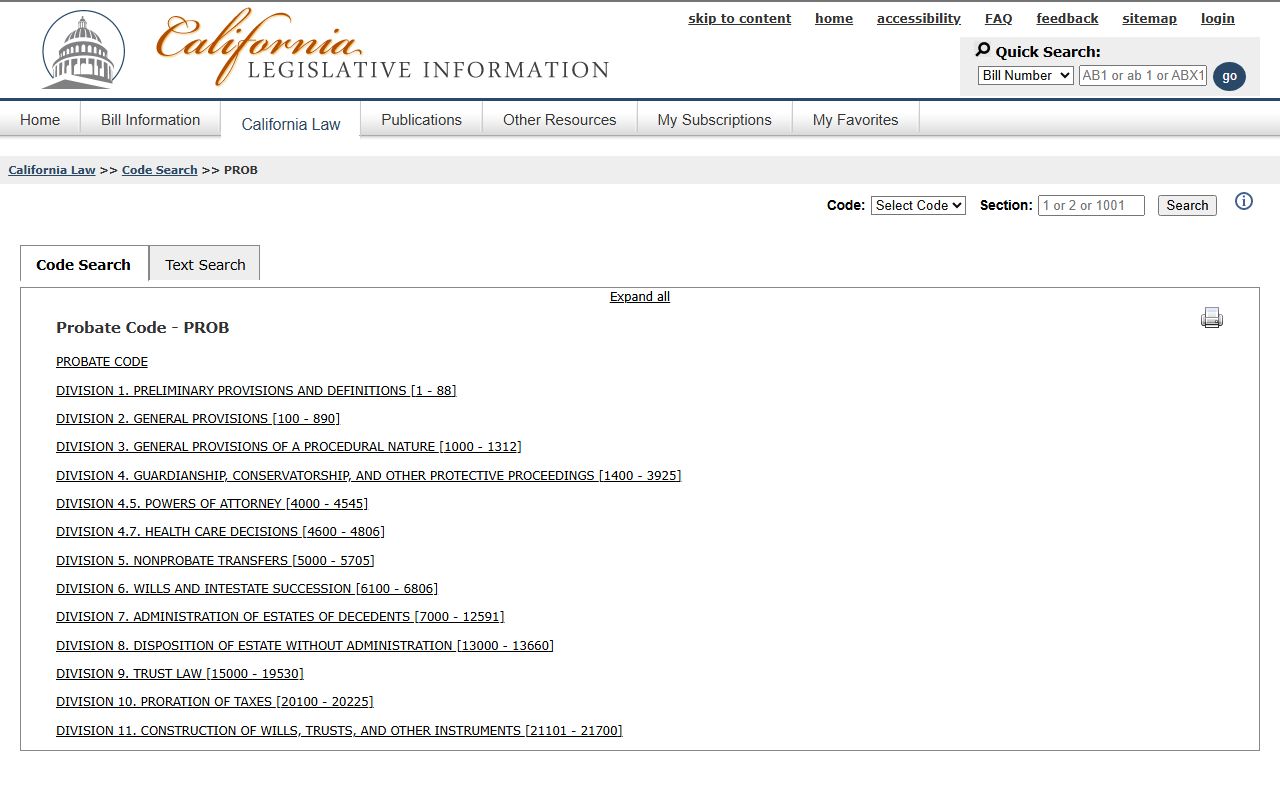

California uses standard forms for probate cases. Download forms from courts.ca.gov or get copies at the courthouse. The DE series covers estate matters. Each form includes instructions explaining how to complete it.

Key forms include DE-111 for the initial petition, DE-140 for the court order, DE-150 for Letters, and DE-160 for the inventory. Form DE-295 handles final distribution and closes the estate. Additional forms apply to specific situations like selling real property or handling claims.

The initial filing fee is $435. Final distribution petitions cost another $435. Certified copies run $40 plus 50 cents per page. Other miscellaneous fees apply to various filings. Request a fee schedule from the clerk if you need to budget for total costs.

The probate referee charges fees based on the value of assets appraised. This is a statutory percentage set by California law. The fee comes from estate funds, not your personal money. The referee's final report shows all fees charged.

Simplified Procedures for Small Estates

Estates valued under $208,850 may qualify for simplified procedures. This threshold applies to deaths on or after April 1, 2025. Earlier deaths use lower amounts. Check which limit applies based on your date of death.

Small estate affidavits work for personal property under the limit. Wait 40 days after death. Then present form DE-310 to banks, brokerages, or others holding property. They must release assets to you without court involvement. No hearing is required.

Real property valued under the limit uses a different process. You still file a petition and attend a hearing. However, the procedure is simpler than full probate. Fewer documents are needed and the timeline is shorter.

Not all estates under the limit qualify for simplified procedures. Creditor claims, disputes among heirs, or complex assets may require full probate. Evaluate your situation carefully before choosing which process to use.

Note: The small estate threshold increases every three years per California Probate Code section 890.

Getting Legal Help

The California Courts self-help website at selfhelp.courts.ca.gov provides free resources. Find forms, guides, and videos explaining probate procedures. The site answers frequently asked questions and offers step-by-step instructions for common tasks.

Legal aid organizations serve Kern County residents who qualify based on income. Greater Bakersfield Legal Assistance provides free legal help to eligible clients. Contact them to learn about income limits and covered services.

Private probate attorneys practice throughout Kern County. Many charge flat fees for straightforward cases. Complex estates typically bill by the hour. The Kern County Bar Association operates a lawyer referral service. Call them to get names of local probate lawyers. Most attorneys offer free initial consultations.

Major Cities in Kern County

Kern County includes Bakersfield, the county's largest city. All probate cases for Bakersfield and other cities in the county are filed at the Bakersfield courthouse. No other Kern County cities have populations over 100,000.

Nearby Counties

For probate matters in neighboring counties, see: Tulare County, Kings County, San Luis Obispo County, Santa Barbara County, Ventura County, Los Angeles County, San Bernardino County, and Inyo County.