Probate Records in Santa Clara County

The Santa Clara County probate division handles estate administration, will contests, conservatorships, and guardianships for the most populous county in the San Francisco Bay Area. All probate cases are filed at the Superior Court in downtown San Jose at 191 North 1st Street. The probate department operates on limited hours: Monday through Thursday from 8:30 AM to 1:30 PM, and Fridays from 8:30 AM to noon. Public records are available for search at the courthouse or through the online portal. Most estate cases take nine to eighteen months from start to finish.

Santa Clara County Probate Quick Facts

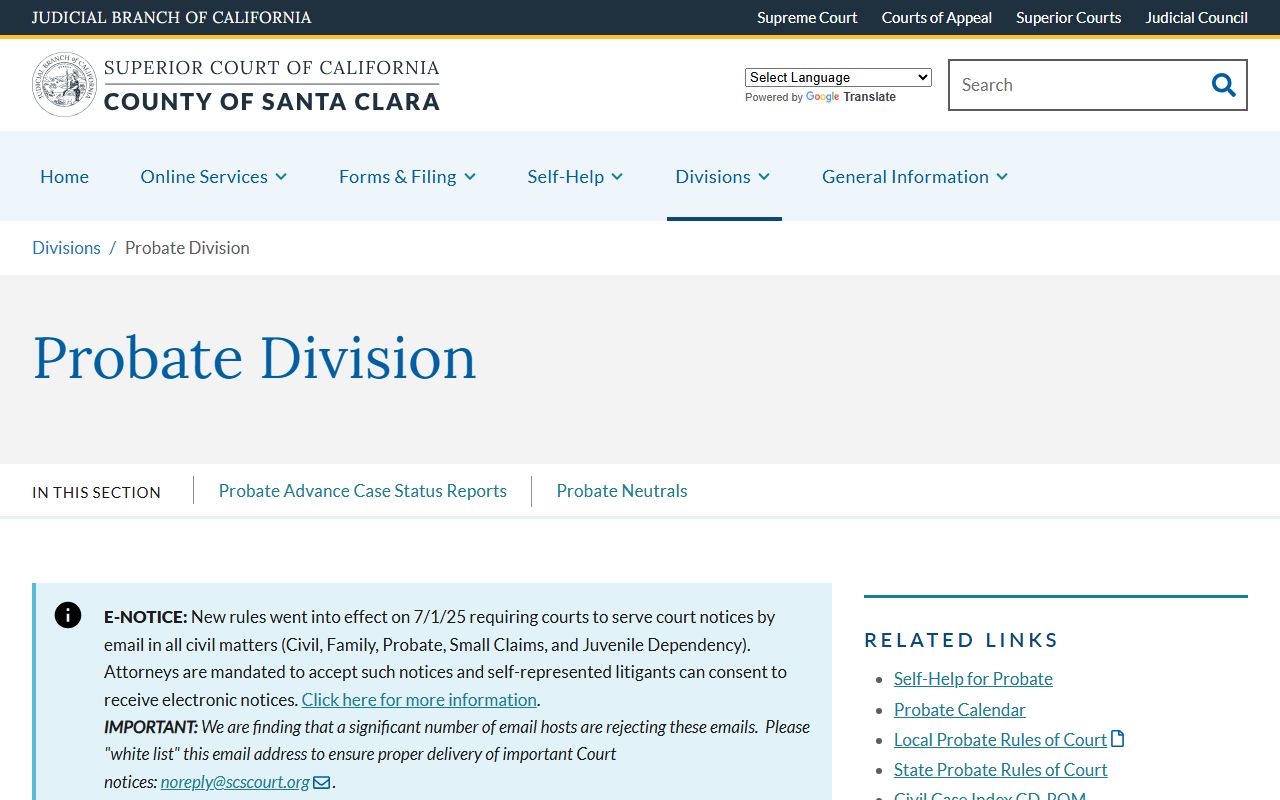

Santa Clara Superior Court Probate Division

The courthouse is at 191 North 1st Street in San Jose. Park in nearby public garages or use light rail, which stops one block away. The probate division is open Monday through Thursday 8:30 AM to 1:30 PM and Friday 8:30 AM to noon. No service on weekends or court holidays.

Call 408-882-2900 for general probate questions. Email ssprobinfo@scscourt.org with case-specific inquiries. Include your case number in the subject line. Most email questions get answered within two business days.

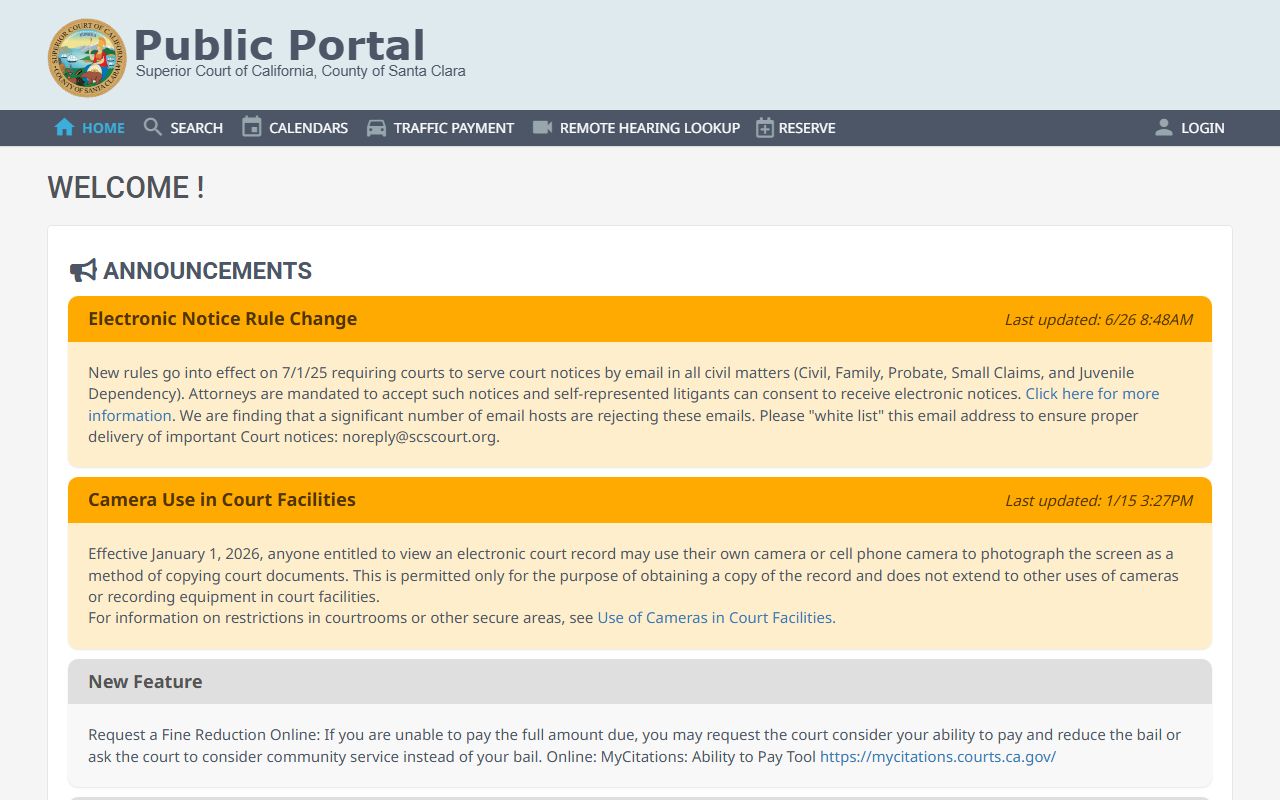

The county uses Tyler Technologies software for case management. You can search cases online at portal.scscourt.org. The portal shows case status, filed documents, and hearing dates. Some documents can be viewed for free. Others require a small fee to download.

Santa Clara County has detailed information about probate procedures on its court website at santaclara.courts.ca.gov. The site includes guides for common tasks like filing a petition, getting letters, and closing an estate. Video tutorials walk through the process step by step.

Search Cases Online

Go to portal.scscourt.org to search probate cases. Enter the last name of the person who died or the case number if you have it. The system returns a list of matching cases. Click on a case to see the register of actions.

The register of actions lists every document filed in the case. It shows hearing dates, tentative rulings, and final orders. Many documents are available to view online at no cost. Certified copies must be requested from the clerk office and cost $40 plus fifty cents per page.

For older cases not in the online system, contact the clerk by phone or email. Historical records may be archived offsite. Retrieval takes extra time, sometimes two to three weeks. The California State Archives in Sacramento also holds Santa Clara County probate records dating to the 1850s.

How to File a Probate Case

Start by getting a certified copy of the death certificate. Order it from the county where death occurred. In Santa Clara County, contact the Clerk-Recorder office. Cost is $28 for the first copy.

Fill out form DE-111, Petition for Probate. Attach the death certificate and the original will if one exists. Take these to the probate clerk window at 191 North 1st Street. Pay the $435 filing fee. Cash, check, money order, and credit cards are accepted.

The clerk gives you a hearing date six to eight weeks out. You must publish notice of the hearing in a local newspaper. Santa Clara County requires publication in The Mercury News or another paper approved by the court. Do this at least fifteen days before the hearing.

Mail notice to all heirs and beneficiaries named in the will. Use certified mail. Keep the receipts. File proof of mailing and proof of publication with the court before the hearing. The probate examiner checks these proofs. If anything is missing, your hearing may be continued.

At the hearing, the judge reviews your petition. If no one objects and paperwork is correct, the judge signs the Order for Probate. You then get Letters, which authorize you to manage estate assets. Take certified copies of the Letters to banks, brokerages, and other institutions.

Within four months, file an Inventory and Appraisal on form DE-160. A probate referee appointed by the court values estate assets. The referee charges a fee based on asset value. Most estates pay between $500 and $2,000 for this service.

Costs and Timelines

Filing fees in Santa Clara County follow state law. The initial petition costs $435. When you close the estate, the final distribution petition costs another $435. Certified copies cost $40 plus fifty cents per page. Recording fees for real property transfers vary.

Most estates take nine to eighteen months to complete. Simple estates with no disputes may finish in six months. Complex estates with real property, business interests, or family disputes can take two years or more.

Attorney fees in probate are set by statute. For a $300,000 estate, the maximum attorney fee is $9,000. For a $500,000 estate, the fee is $13,000. Many attorneys charge the statutory maximum. Some offer flat fees for straightforward cases.

You can handle probate without an attorney if the estate is simple. The court self-help center provides free assistance with forms. Staff cannot give legal advice but can explain what each form requires. Many people successfully complete probate on their own and save thousands in attorney fees.

Small Estate Options

Estates worth less than $208,850 qualify for simplified procedures. Use form DE-310, Affidavit Re Real Property of Small Value, or form DE-305 for personal property. No court hearing is needed for the affidavit. Just fill it out and take it to whoever holds the assets.

Wait 40 days after death before using the small estate affidavit. Banks and other institutions must accept a properly completed affidavit. This saves time and money compared to full probate.

Real property under $70,200 can be transferred with a court petition but without full probate administration. The fee is $435. One hearing is usually enough. The process takes about three months.

Surviving spouses may use a Spousal Property Petition on form DE-221. This works for community property and for separate property left to the spouse by will. The filing fee is $435. Most spousal petitions are approved at the first hearing.

Note: The small estate limit increases every three years. The current $208,850 limit runs from April 1, 2025 through March 31, 2028.

Finding Legal Assistance

The court self-help center is on the first floor of the courthouse. Free help is available with filling out forms. No appointment needed. Walk in during business hours. Staff can answer questions about procedures but cannot tell you what to do in your specific case.

Several legal aid organizations serve Santa Clara County residents:

- Senior Adults Legal Assistance: 408-295-5991

- Law Foundation of Silicon Valley: 408-280-2424

- Legal Aid Society of Santa Clara County: 408-998-5200

These groups provide free help to people who qualify based on income. Services include advice, form preparation, and sometimes court representation. Most focus on helping seniors and low-income families.

The Santa Clara County Bar Association runs a lawyer referral service. Call to get names of probate attorneys. Many offer free consultations. Compare fees before hiring. Some lawyers charge hourly rates instead of statutory fees and may cost less for simple estates.

Probate Forms

Download all California probate forms at courts.ca.gov. Forms are free. You can fill them out on a computer or print and complete by hand. Use blue or black ink if writing by hand.

Key forms include DE-111 to start the case, DE-140 for the court order, DE-150 for Letters, and DE-160 for the Inventory. Form DE-295 closes the estate. All are available in English and Spanish.

Santa Clara County has local forms for certain procedures. Check the county court website for local forms. Use both the statewide Judicial Council forms and any required local forms. Missing a local form can delay your case.

Related County Services

Death certificates come from the County Clerk-Recorder office. The office is at 70 West Hedding Street in San Jose. Order online, by mail, or in person. Cost is $28 for the first certified copy and $14 for additional copies ordered at the same time. Only family members and legal representatives can order death certificates.

If the estate includes real property, you work with the recorder office to transfer title. After the judge signs the final distribution order, record the order with the property deed. Recording fees depend on the number of pages in your document.

Property tax bills continue during probate. Pay them on time to avoid penalties. Contact the county assessor if you have questions about property tax during estate administration. Some estates qualify for tax relief or deferrals.

Major Cities in Santa Clara County

Santa Clara County includes several cities with populations over 100,000: San Jose, Sunnyvale, and Santa Clara. All probate cases for residents of these cities are filed at the county courthouse in San Jose.

Other cities in the county include Palo Alto, Mountain View, Milpitas, Cupertino, Los Gatos, Saratoga, Campbell, and Morgan Hill. No cities operate their own probate courts. All cases go through Santa Clara County Superior Court.

Nearby Counties

For probate cases in neighboring counties, visit: Alameda County, San Mateo County, Santa Cruz County, Stanislaus County, and Merced County.